TAD for Trade and CSA Management

TAD automates many of the processes required for brokers, buy-side and sell-side firms for MIFID I & II so that they are in control and can demonstrate to the regulators that they know what business has been done, for whom, and at what cost.

TAD for Trade and CSA / RPA allows a business to track Brokerage Fees and Client Services Agreements invoicing and payments. TAD automates trade and cash reconciliation, fee allocation, client views of business done and ultimately client full P&L atribution and firm level P&L and provides Regulatory Reporting for appropriate transactions.

With a fully managed service, on a monthly fixed fee basis, TAD is the most cost effective way of firms meeting their regulatory requirements, without huge investment in infrastructure, build or expensive to implement packaged solutions.

Key functionality and solution benefits:

- Provides an automated solution to MIFID reporting of trades, venue volumes, concentrations, credit limits, P&L

- Replaces costly manual processes for administering FO/BO trade flows

- Matches and reconciles daily trades from OMS and Settlement systems

- Assigns cleared trade data to specified client accounts

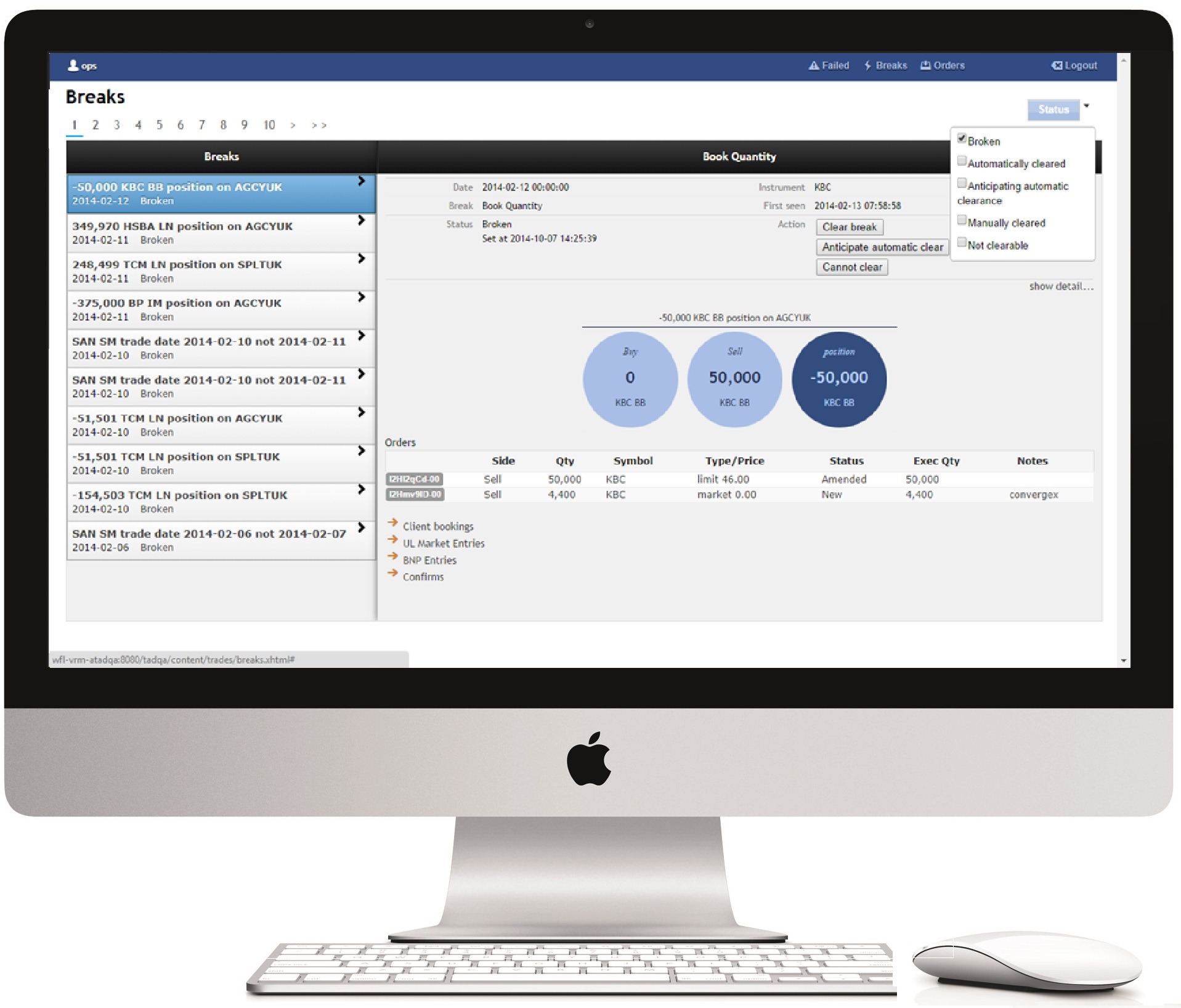

- Identifies and flags exceptions/failures to the operations team for investigation and escalation.

- Enables operations team to manage the status of all exceptions whilst automatically clearing the backlog as trade data is updated.

- Manages research CSA or RPA style subscriptions income stream, or fixed payment streams

- View brokerage and research subscription income down to individual client and provider level.

- Generate Scheduled, CSA / RPA and Ad-Hoc invoicing for subscribing research clients.

- Maintain records of Voting and Payment schedules for CSA clients, view upcoming events calendar.

- Single management system for client billing and payment records.

- Manage allocations of brokerage incomes

- Assign brokerage fee income / expenses between departments or regional businesses.

- Correctly assign proportions of brokerage fee income for Step-In, Step-out transactions.

- Generate a range of operational and financial reporting including

- Daily Trade Blotter (with electronic sign-off process)

- Profit and Loss on trading activity

- Departmental, Location, company/entity level

- End of Period financial reporting (Daily/Weekly, YTD etc)

- Client level income reporting combining brokerage and research income streams

- Range of client credit limit reports

- Ad-hoc internal reports and trading updates delivered via email

- Regulatory reporting for FCA, ISMA etc.

[gview file=”/wp-content/uploads/2015/01/worldflow-Connect-Trade-Reconsiliation-and-Reporting-Solution.pdf”]